The formation of further technology and rising competition are now making risk management challenging. According to a report, 60% of businesses struggle with compliance and regulations, whereas 85% of businesses have high risks from cybersecurity. It’s an everyday struggle to stay ahead in a world with evolving regulations and risks.

Artificial intelligence (AI) has affected risk and compliance domains. It can easily understand, recognise, analyze situations, and choose accordingly. Moreover, AI can easily predict the potential risks in businesses earlier, so the process can run smoothly.

Many companies in the US, Europe, Africa, and Asia use AI to identify problems better and earlier. So, if you also want to know how these big companies manage risk and compliance with the help of AI, this blog is for you.

Explore how artificial intelligence revolutionizes the risk and compliance environment worldwide.

Table of Contents

Global Perspectives on AI in Risk and Compliance

There are many views worldwide on how to manage risks and rules for (AI). Here are some key points:

- EU AI Act: The European Union is working on a law called the AI Act to set rules for AI use in its countries. The law will classify AI systems into different risk levels. It will impose stricter regulations on higher-risk applications, such as those in healthcare or law enforcement across the EU.

- US Executive Orders: The President of the United States signed a new order to regulate AI. New executive orders focus on transparency, bias reduction, and privacy protection, ensuring AI technology remains ethical and reliable.

- G7 Code Of Conduct: The G7, a group of major economies, released a set of guidelines for AI. These guidelines emphasize cross-border collaboration to address challenges like data security, ethical use, and AI governance. This is part of a global effort to manage AI safely and responsibly.

- UK AI Safety Summit: The UK held a summit to discuss the risks and opportunities of advanced AI. The summit highlighted the importance of aligning AI development with ethical standards and societal values. Many countries agreed to work together to ensure AI is safe and responsible.

- China’s AI Law: In August 2023, China introduced a new law that sets rules for developing and using AI in the country. The law includes provisions for transparency, accountability, and regular audits of AI algorithms to prevent misuse and maintain public trust.

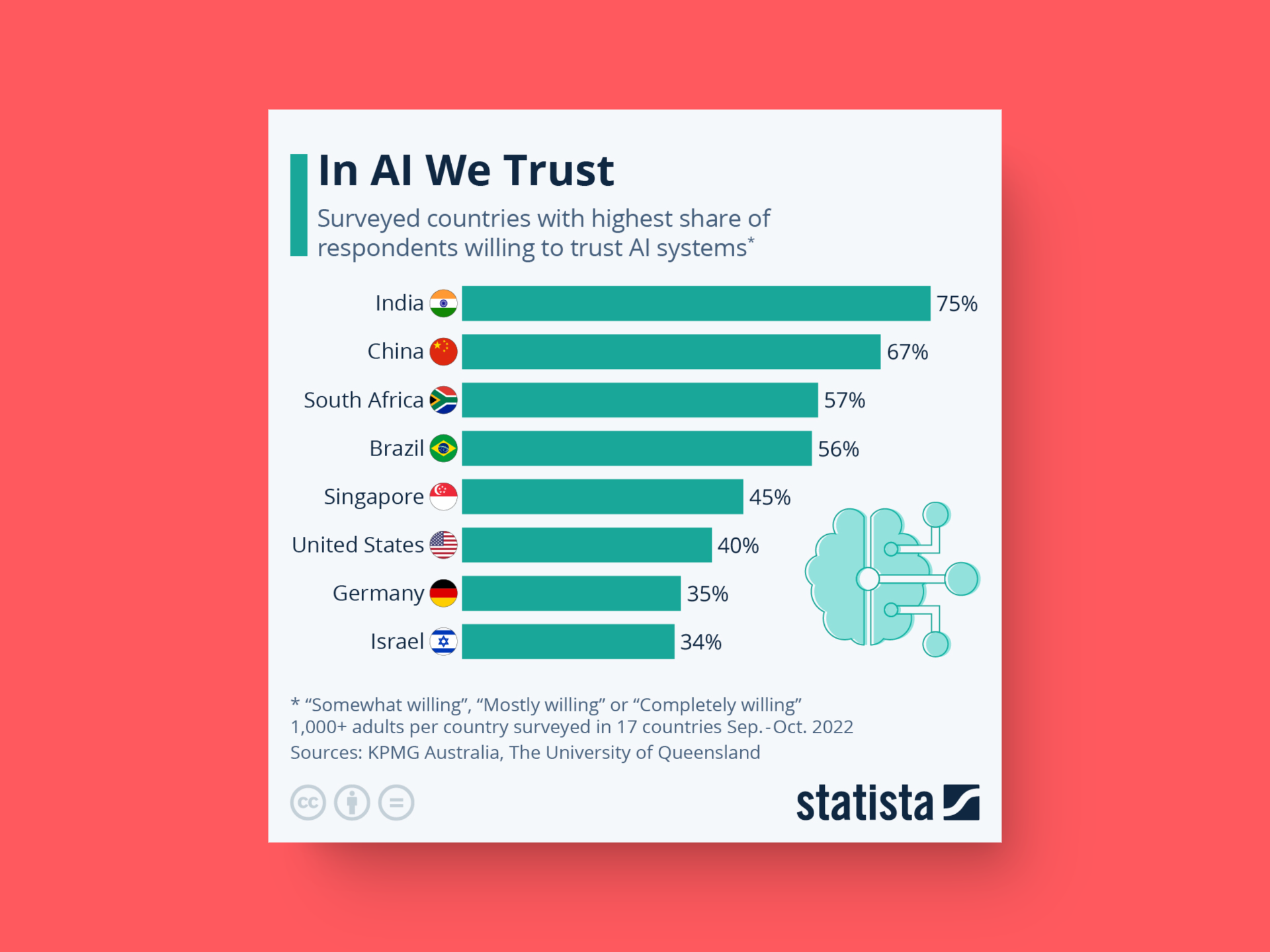

- Survey Insights:

Recent surveys reveal significant insights into AI adoption across various regions and sectors. Here’s a summary:

Regional Breakdown:

- Europe & Africa: The survey results indicate that AI adoption is growing fast in the European market.

- Americas: In the Americas, particularly the U.S., AI adoption is strong, with 96% of surveyed SAP customers indicating executive mandates to explore or implement AI technologies. Additionally, 69% use AI for IT infrastructure management and 49% for marketing and sales operations.

- APAC (Asia-Pacific): This region shows the most significant increases in generative AI use, particularly in marketing and sales functions, reflecting a growing interest in AI tools.

Sectoral Insights:

- Banking and Finance: AI enhances security and customisation, and adoption rates have significantly increased.

- Healthcare: The sector is leveraging AI to improve diagnostics and patient care, indicating a transformative impact.

- Information Technology (IT): AI adoption is high, with many companies integrating AI into their operations for efficiency.

- Manufacturing: AI is driving brilliant industrial transformations, helping companies optimise processes.

- Customer Service: Organizations increasingly invest in AI for self-service and assisted service needs, focusing on analytics and improving customer experiences.

Current adoption and benefits of AI:

Many organizations rely on AI to improve their risk and compliance processes for the following reasons

- Trends in Early Adoption: Those companies that started using AI earlier have already gained benefits. AI allows businesses to control risks and look at compliance more efficiently.

- Principal Advantages: Efficiencies Gained by Reports: AI can automate many manual processes. Furthermore, automation speeds up and improves the efficiency of the work.

- Enhanced Risk Identification: AI identifies dangers far more quickly and precisely than usual techniques. Accenture claims that AI can identify possible threats 30% faster, enabling businesses to solve issues earlier.

- Tighter Fraud Detection: AI identifies fraudulent activities by recognising patterns that human analysts might miss. This makes detecting and preventing fraud easier, saving businesses billions of dollars annually.

- Cost Savings and Error Reduction: AI has the potential to save a lot of money and reduce errors. According to PwC, businesses that use AI for risk and compliance can save up to 30% on expenses leading to substantial savings, especially for large organizations with complex risk chances.

- Data Processing and Quality Gains: AI efficiently manages large volumes of data, improves data quality, and enables better decision-making. This is crucial in sectors like finance, where accurate data is essential for regulatory compliance.

Practical applications of AI deployment in risk and compliance

AI is revolutionizing how companies manage risk and ensure compliance. Here are some of the most practical applications:

1. Fraud detection and prevention:

AI algorithms can quickly analyze large amounts of data to spot suspicious patterns and prevent fraud. For example, AI can detect irregular spending on credit cards or identify potential money laundering activities.

2. Credit risk assessment:

AI helps lenders make more informed decisions by evaluating loan applications using extensive data. It detects the application for factors like transaction history, savings habits, and even non-traditional data like bill payments to understand creditworthiness better.

3. Compliance Monitoring:

AI can automate compliance processes and continuously monitor adherence to regulations. It can quickly identify potential non-compliance issues to avoid penalties and reputational damage.

4. Market risk analysis:

AI can process real-time market data, news, and social media to provide insights into trends, liquidity risks, and other factors. This helps financial institutions make better decisions and mitigate risks.

5. Supply chain risk prediction:

AI can analyse data from various sources to predict and mitigate risks in supply chains. For example, it can forecast demand, optimise inventory, and anticipate potential disruptions.

6. Employee misconduct detection:

AI can help detect subtle employee misconduct that traditional methods might miss. By analysing data from various sources, AI can identify patterns and red flags to prevent issues.

7. Automation and efficiency:

AI is revolutionising risk management and compliance by automating key processes and enhancing efficiency across various industries. Here are some key ways AI is driving automation and improving operational effectiveness:

- Improved Accuracy: AI enhances the precision of risk assessment and compliance monitoring processes.

- Faster Identification of Issues: AI can quickly spot potential problems and risks, enabling prompt mitigation.

- Large-Scale Data Processing: AI can analyze vast amounts of structured and unstructured data from multiple sources.

- Continuous Monitoring: AI systems provide real-time monitoring and adapt to evolving risks.

- Enhanced Decision-Making: AI-driven insights support more informed risk management strategies and decisions.

Types of models used in compliance AI

1. LLMs (Large Language Model)

LLMs are very large deep learning models that are pre-trained on vast amounts of data. LLMs are one of the most advanced AI model that can

- read and understand complex legal and regulatory texts

- Automate interpretations of complex compliance rules

- Generate compliance reports and summaries based on different factors

In fact, Moody’s latest report clearly mentions that 41% of users associate LLM with risk and compliance.

2. Natural Language Processing (NLP) Models

NPL model specializes in processing and understanding human language. It can be used for sentiment analysis, entity extraction and text classification in compliance contexts. NLP models are responsible to

- Enhance AI’s capability to generate quicker response

- Increase work efficiency

- Improve customer experiences

- Lower operational risk

3. Rule-Based Models

Rule-based models completely rely on predefined rules and logic often created by human experts based on situations. These models apply specific “if-then” conditions to data, making them ideal for straightforward compliance tasks with clear regulations. They’re simple to implement and cost-effective, offering transparency in decision-making processes.

Case Study: Accenture has launched their Responsible AI Compliance Model

A notable case study where a company has used AI for its operations is Accenture. The company developed a Responsible AI Compliance program to ensure its use of AI technology is ethical and practical. Accenture recognised the potential risks associated with AI, such as bias, ethical concerns, and cybersecurity threats. To address these issues, they created a program focusing on the responsible use of AI within their organization.

This program includes:

- Training: Accenture provides responsible AI training to its employees, ensuring they understand how to use AI ethically and effectively.

- Governance: They established principles and guidelines to govern AI use, helping to build trust with clients and stakeholders.

- Implementation: The program is designed to activate ethical AI practices in real-life applications, enhancing the company’s operations while mitigating risks.

Accenture aims to lead by example by focusing on responsible AI. This internal initiative demonstrates how companies can use AI while maintaining ethical standards, improving their processes and setting a benchmark for other organizations looking to implement AI responsibly.

Ready to transform compliance for your regulatory processes?

If you’re looking for a compliance AI software to make your regulatory easier, smoother, and 10x faster, we recommend using GoVisually.

With GoVisually’s AI compliance software, you can review thousands of labels four times faster and eliminate about 1-2% human error to eliminate compliance risk completely.

Don’t just take our word! Check out our free label scoreboard here and see why our customers love it.